- SWIFT

- Недвижимость

- The Role of ESG in Real Estate: Creating Sustainable and Profitable Portfolios

The Role of ESG in Real Estate: Creating Sustainable and Profitable Portfolios

Have you ever wondered how sustainability really pays off in the built environment? We’ve seen plenty of sensational ESG real estate talk, but here, we cut to the core. As we guide you through case studies, stats and practical strategies, you’ll nod your head thinking, “Yes, that applies to my holdings.”

If you’re aiming for ESG real estate that truly performs and endures, you’re in the right place.

Embedding ESG Improves Resilience and Risk Management

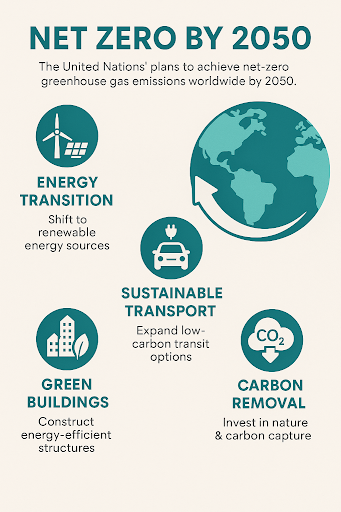

Market forces and regulations are reshaping real estate. Insured and uninsured climate risks are climbing and buildings lagging in Net-Zero readiness face obsolescence. We proactively screen for vulnerabilities, prioritizing structures with energy risk and climate stress assessments. By acting early, we protect portfolios and secure long-term resilience.

Green Certification Commands Higher Rents and Valuations

Our experience confirms what research shows: ESG-certified buildings outperform financially. In Europe, green-certified offices can command 6% higher rents, with capital values rising 14–16%. Beyond cost savings, certification boosts occupier appeal; tenants prioritize efficient, healthy spaces, helping us maintain strong occupancy and premium positioning.

Reduced Operational Costs Drive Cash Flow

Investing in smart systems and energy efficiency yields immediate benefits. Energy-efficient HVAC, lighting and sustainable materials reduce maintenance costs by 2.5–5%. That translates into stronger NOI, tighter cap rates and better financing terms because lenders recognize lower environmental risks.

ESG Real Estate Boosts Tenant Retention and Well‑being

Well-being first: tenants today care about health, wellness and community. This is made real through air-quality sensors, green spaces and community engagement policies, not buzzwords. Industry leaders continue to highlight strong demand for ESG-compliant, low-carbon workspaces. In response, our portfolios deliver spaces where occupants thrive – and stay longer.

Better Access to Financing and Investor Appeal

ESG credentials aren’t just eco-friendly, they’re investor magnets. Buildings with strong ESG scores attract sustainable capital and may secure favourable debt terms. Through Global Real Estate Sustainability Benchmark (GRESB) validation, we benchmark performance and enhance credibility; studies link high GRESB scores to fund-level financial gains in real estate.

Regulatory Compliance and Future-Proofing

Regulatory landscapes are tightening. The UK is pushing aggressive Net Zero by 2050 targets, with minimum energy standards and performance disclosures on the horizon. Through proactive asset profiling, ESG integration and sustainability benchmarking, we help future-proof portfolios and reduce exposure to stranded asset risk.

Long-Term Value Creation Through ESG Integration

Viewed holistically, ESG is the ultimate value driver. Knight Frank concludes that 2025 corporate real estate strategies will lead with ESG – demonstrating that sustainability equals smart business. We integrate environmental impact, governance quality and social responsibility into asset due diligence and operational frameworks.

At Swift Holding, we integrate ESG real estate principles into every stage – from valuation to ongoing management. We actively optimise for climate resilience, tenant wellness, financial returns and regulatory compliance. By doing so, we craft high-performing, future-ready portfolios that align profitability with planet-friendly impact.

Discuss leading ESG real estate strategies to future-proof your investment success.