A Beginner’s Guide to Real Estate Development in the UK

You just discovered a promising plot and thought, “Why not develop it?” But then the forms, plans and finance issues arrived – and your enthusiasm wavered. That’s normal.

Starting in 房地产开发 in UK markets can feel daunting. This beginner’s guide will walk them through each stage – from site scouting to completion – so you can nod in recognition, breathe easier and feel ready to take action.

Savvy Planning For UK Real Estate Development

In today’s UK climate, real estate development requires more than casual interest. With housing demand climbing, affordability under pressure and stamp duties in flux, only those armed with clear strategy and local knowledge move from ambition to achievement. For newcomers, navigating real estate development in UK markets begins with a well-informed plan.

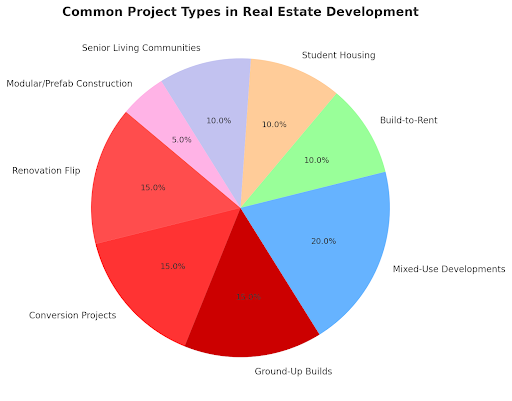

Choose The Right Project Type

First-time developers typically explore:

- Renovation Flip: Acquire outdated residential property, refresh it and sell for profit. This model can be faster and require lower upfront costs.

- Conversion Projects: Repurpose commercial spaces (like offices) into residential units especially hot now, given reduced new office builds.

- Ground-Up Builds: Purchase land and create a new development from scratch. This route offers the greatest flexibility and complexity.

Get Feasibility and Planning Right

Every real estate development starts with feasibility:

- Estimating costs.

- Timeline.

- Prospective returns.

UK developers must factor in construction, soft costs, planning fees like SDLT and contingency budgets of 10%-15%. Navigating the UK’s plan-led development system and 421 local planning authorities adds further requirements for due diligence.

Secure Financing and Mitigate Risk

Funding is often the biggest hurdle for beginners. Options include bridging loans, development finance and equity partnerships. They must choose based on project scale, holding period and risk exposure.

Bonus: strong forecasts – accounting for inflation and economic forecasts – will support lender confidence.

Consider Market Timing and Location

Understanding current UK trends is critical. House prices rose 0.5% in May 2025 and hit records around £273,427 amidst fluctuating stamp duty. Yet volatility remains and savvy developers can leverage dips or favourable financing with the right timing informed by real estate experts. Targeting emerging locales with strong rental demand, like Northern regions or commuter belts, has already proven to be a strategic move for developers seeking long-term growth and stable returns.

Build a Strong, Adaptive Team

New developers should assemble reliable partners: planners, architects, contractors, surveyors, real estate consultants and legal advisors familiar with UK regs. Each brings vital insight, whether deciphering zoning changes or managing ESG standards.

Focus On Active Management and Exit Strategy

Developers who succeed in the UK don’t only build, they actively manage and plan exits. That could mean selling completed units, leasing residential blocks or even listing as REITs – structures with favourable tax treatment under UK REIT legislation. Staying hands-on ensures high returns and reduces exposure to market shifts.

Why Swift Holding Guides Your First UK Project

Swift Holding brings global experience with €10 billion+ in investments and proven strategies delivering 20%+ ROI. Our experts blend sector insight with deep planning expertise, empowering novices entering complex UK development markets confidently.

Launch your first UK real estate development success story today.