- SWIFT

- Immobilier

- How Real Estate Asset Management Maximizes Property Value Over Time

How Real Estate Asset Management Maximizes Property Value Over Time

Maximizing real estate value over time requires more than just good luck, gut feels and tips from the putting green. It takes careful strategy, consistent market analysis and proactive management.

Successful investors know that real estate asset management is multi-faceted and dynamic – starting with maintaining property and peaking with constant leveraging of each asset’s full potential. With expert insights and a tailored approach, real estate portfolios can thrive and grow, even amidst market fluctuations.

Why Real Estate Asset Management Matters

Effective real estate asset management is incorrectly described as “overseeing a property”. Its service involves a comprehensive, data-driven strategy that enhances the performance of each asset in the portfolio. By focusing on factors such as maintenance, tenant retention, market positioning and investment analysis, our team of global connoisseurs in real estate ensures that each property meets current market standards and stands out for future growth.

Whether it’s a commercial office building, residential estate or industrial complex, strategic asset management drives multi-level, long-term success. It’s about ensuring the property performs optimally in terms of diverse financial returns and operational efficiency.

“…the cumulative potential impact of property management services estimated on this basis can reach up to ca. 30% of the dwellings’ value.”

Source:https://link.springer.com/article/10.1007/s10901-023-10032-2

Maximizing Property Value Through Maintenance and Upgrades

Regular maintenance and strategic upgrades are pivotal in boosting property value. A well-maintained property holds its value better over time, ensuring that minor issues do not evolve into costly repairs.

Asset managers work with property owners to prioritize upgrades that yield the highest return on investment (ROI). For example, energy-efficient improvements like HVAC upgrades or the installation of renewable energy systems can significantly reduce operating costs while making the property more attractive to tenants.

Beyond simple maintenance, asset management can involve a more proactive approach, such as strategically redeveloping older properties or adapting spaces to meet modern needs. This includes renovations that improve both aesthetics and functionality, making the property more desirable in a competitive market.

Navigating Market Trends to Enhance Returns

Real estate asset managers keep a keen eye on shifting market trends, including changes in rental rates and rental areas, demand for different types of properties, and the impact of economic cycles. By understanding these trends, asset managers can make informed decisions on property acquisitions, dispositions or refinancing to optimize portfolio performance.

Additionally, through strategic leasing, asset managers ensure that properties attract high-quality tenants, contributing to a steady cash flow. Maintaining low vacancy rates is crucial, as it directly impacts a property’s profitability and long-term value.

Leveraging Data and Analytics

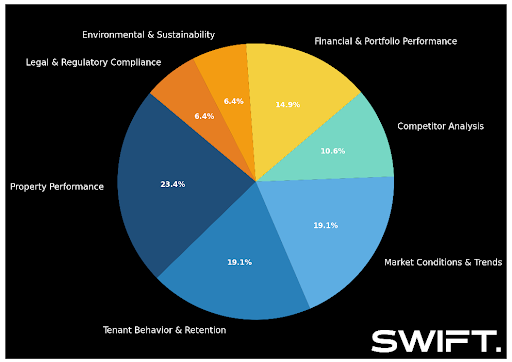

Data-driven decision-making is essential in today’s real estate market. Asset management involves collecting and analyzing diverse data, including property performance, tenant behavior, and market conditions. By using advanced analytics tools, our team stays at the forefront of excellence, anticipating changes in property values, identifying growth opportunities, and avoiding potential risks on behalf of our esteemed clients.

The data we selectively harvest has been informed by our esteemed asset management journey, which mirrors our portfolio of trusted clients. The results we achieve are a testament to these enduring partnerships and shared visions of success.

We empower our property-owning clients to understand their assets’ position dynamically relative to competitors, ensuring well-maintained properties that are priced competitively. This can lead to higher occupancy rates and market-leading returns on investment.

Long-Term Strategic Planning

Real estate asset management involves setting long-term goals that align with the client’s broader investment strategy. By developing a comprehensive long-term plan, asset managers ensure that every property in the portfolio contributes to building a legacy of value. This includes evaluating when to sell or acquire new properties, diversifying asset types within the portfolio, and creating exit strategies that maximize profits. By doing so, real estate asset management ensures that properties are well-positioned for both short-term gains and long-term financial stability.

Your Next Steps

Real estate asset management is a crucial component of maximizing property value over time. Elite entities across various industries and like-minded clients have recognized our dedication to upholding the highest standards of asset management service and innovation. Our dynamic focus on maintenance, economics, market trends, data-driven decisions, and long-term planning keeps our clients ahead of the curve with deeply sustainable growth.

Boost your portfolio value exponentially with leading real estate asset management.